Photo by AbsolutVision on Unsplash

Simple Ways to Protect and Grow Your Money

Monitor your financial situation and spending with budgeting applications

In this article, we will explore strategies and tips to help you effectively manage and grow your wealth. These recommendations serve as a guide, to making decisions and taking control of your financial well-being and how important a tool such as expenses tracker is. Let's jump in!

Keeping Track of Your Expenses Using Excel

A crucial step towards achieving stability involves monitoring your expenses. By maintaining a record of your spending patterns you can identify areas where you may be overspending and make adjustments. One effective method for tracking expenses is by utilizing tools like spreadsheets, an expense tracker in Excel or an expense tracker template. These tools, such as the Basic Personal Budget or Easy Monthly Budget available in Excel provide an overview of your monthly income and expenditure data while allowing easy sorting and filtering options [0]. You can also find templates like the SimpleBudget Spreadsheet or Expenses Calculator that offer breakdowns of your expenses and earnings [1].

Establishing Clear Financial Objectives

Having defined goals is crucial for preserving and expanding your wealth. Whether it's saving, for retirement purchasing a home or paying off debts setting objectives helps maintain focus and motivation. Ensure that your goals are relevant and time-bound (SMART goals). Creating and sticking to a budget is a step, in improving your money management skills. It allows you to keep track of your income and expenses identify areas where you can cut back if needed and ensure that you live within your means. To get started you can utilize Excel's budget templates like the Personal Monthly Budget Worksheet or Money Manager [3][4]. These templates assist in documenting, tracking and managing your finances including income, expenses and savings so that you can work towards achieving your goals.

Automating your savings can greatly contribute to building wealth over time. You can establish a system where a specific amount of money is automatically transferred to a savings or investment account. This way you prioritize. Avoid the temptation of spending that money

Effectively managing and reducing debt plays a role in management. Start by paying off high-interest debts such as credit card debt or personal loans. It may be helpful to create a plan, for paying off debts through payments. As you reduce your debt you'll have resources at your disposal, for savings and investments.

Getting Professional Financial Guidance

If you're unsure about how to handle your finances or need help reaching your goals don't hesitate to seek advice from an advisor. They can offer guidance assist in creating a plan tailored to your specific needs and help address any unique situations to ensure that you make well-informed decisions.

Conclusion

Remember, effectively managing your finances and ensuring their growth requires dedication, regular assessments and necessary adjustments. By implementing these recommendations and utilizing tools like an Excel expense tracker or template you'll be able to take charge of your affairs make progress toward achieving your objectives and establish enduring stability. Begin your journey, towards a future today.

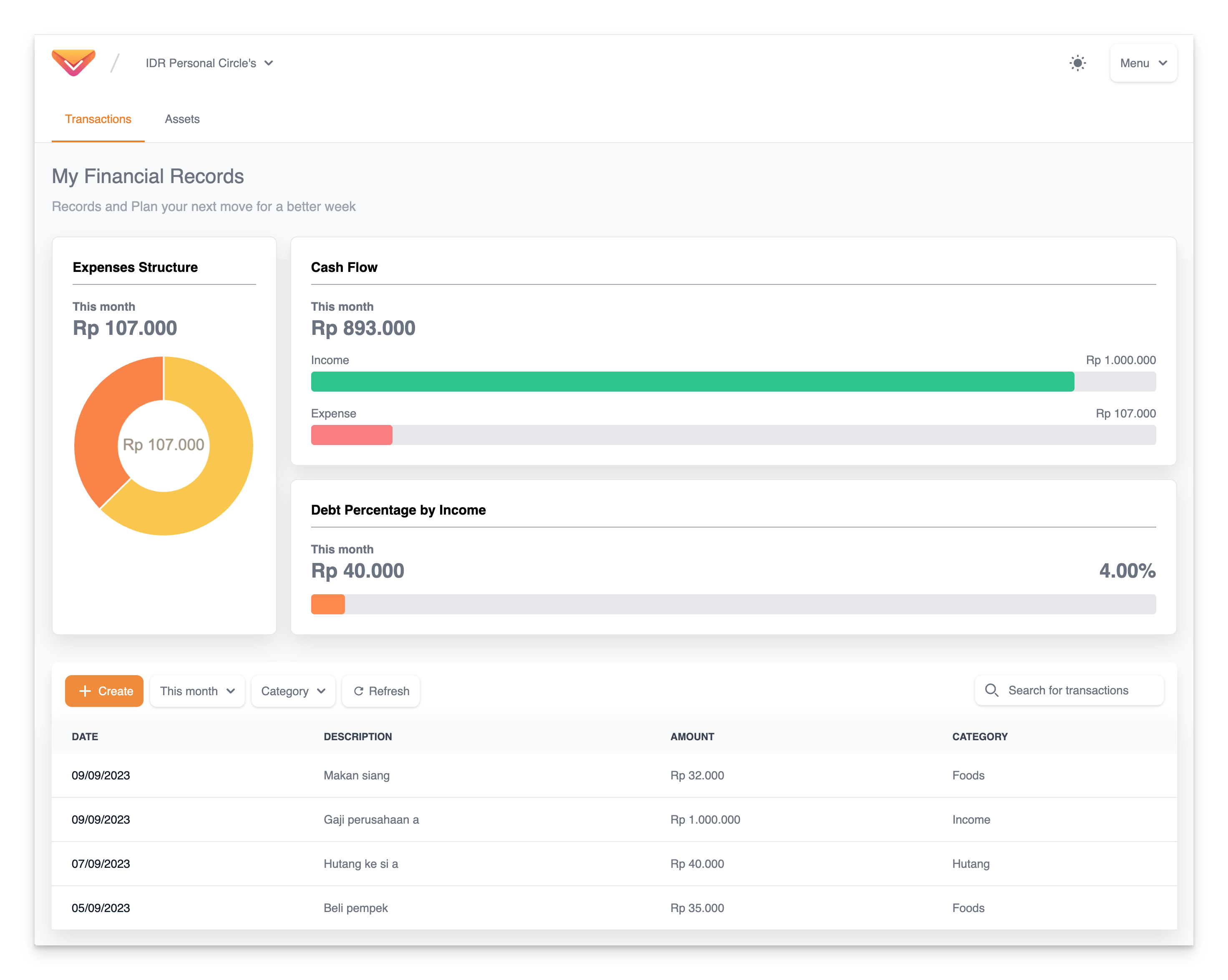

Introducing Inving - A Platform for Evaluating Your Expenses

Understanding our finances is incredibly important especially when it comes to examining our expenses. It's crucial to have an understanding of where our money is being spent and identify areas where we can improve our spending habits. This is where Inving comes in – it's an expenses tracker template that helps us stay on top of our expenses and make informed decisions.

When considering alternatives, for tracking expenses using Excel, Inving truly stands out as a solution. It's not your tool, it's a free personal expenses tracker that allows you to keep track of your spending without any additional charges.

Moreover, Inving serves as the budgeting app for couples enabling them to manage their joint expenses transparently. It goes beyond expense tracking. Also offers features for efficient portfolio management.

With Inving managing your investment portfolio becomes effortless and precise making it an inclusive tool, for all your needs.